Master Your Money: The Power Of The Albert Financial App

In today's fast-paced world, managing personal finances can often feel like an overwhelming task. From tracking expenses and building savings to navigating investments, the complexities can deter even the most financially savvy individuals. This is where a powerful, intuitive financial companion becomes invaluable. Imagine having an intelligent assistant that not only helps you see where your money goes but also guides you towards smarter financial decisions.

Enter Albert, a revolutionary financial app designed to simplify and optimize your money management journey. With millions of users already benefiting from its comprehensive features, Albert stands out as an all-in-one solution for budgeting, saving, spending, and even investing. It's more than just an app; it's a personal financial guide aimed at empowering you to take complete control of your finances, ensuring you build a more secure and prosperous future.

Table of Contents

- Unlocking Financial Control with Albert: An Overview

- Getting Started with Your Albert Journey: Seamless Setup

- Smart Savings: High-Yield Accounts and Automated Genius

- Navigating Your Money: Transactions and Withdrawals

- Beyond the Basics: Advanced Features and Support

- Why Millions Trust Albert: A Community of Financial Empowerment

- Albert's Commitment to Your Financial Well-being

- Conclusion: Take Control with Albert Today

Unlocking Financial Control with Albert: An Overview

At its core, Albert is built on a simple yet profound premise: to make financial management accessible, intelligent, and effective for everyone. The app is meticulously designed to help you "Take control of your finances with Albert," transforming what was once a daunting chore into an intuitive and empowering experience. It serves as your personal financial hub, consolidating various aspects of your monetary life into a single, user-friendly interface. This integration is crucial in an age where financial data can be scattered across multiple platforms, making it difficult to get a holistic view of one's economic health.

The vision behind Albert is to empower users not just to track their money, but to actively optimize it. By providing clear insights into spending habits, suggesting smart saving opportunities, and offering avenues for growth through investing, Albert goes beyond basic budgeting. It acts as a proactive partner, guiding you towards better financial habits and helping you achieve your long-term goals. The comprehensive nature of the app ensures that whether you're just starting your financial journey or looking to refine existing strategies, Albert offers the tools and guidance you need to succeed.

The Power of an All-in-One App: Budget, Save, Spend, and Invest

One of the most compelling aspects of the Albert app is its comprehensive suite of features, allowing you to "Budget, save, spend, and invest, all in one incredibly powerful app." This integrated approach eliminates the need for multiple financial tools, streamlining your efforts and providing a cohesive view of your financial landscape.

- Budgeting: Albert intelligently analyzes your income and spending patterns, helping you create realistic budgets that stick. It categorizes your transactions, making it easy to identify where your money is going and pinpoint areas for potential savings. This granular insight is vital for effective financial planning, allowing you to make informed decisions about your discretionary spending.

- Saving: Perhaps one of Albert's most celebrated features is its automated savings mechanism. The app "analyzes your income and spending to find small amounts we think you can afford to set aside, and we move your money automatically based on your settings." This "Genius" feature removes the guesswork and discipline often required for consistent saving, making it effortless to build up your emergency fund or save for specific goals without feeling the pinch.

- Spending: While encouraging savings, Albert also provides tools to manage your daily spending. Through features like the Albert Cash debit card, you gain clear visibility into your transactions, ensuring you stay within your budget. The app's ability to track and categorize spending helps you maintain awareness and control over your cash flow, preventing unexpected overdrafts and promoting responsible spending habits.

- Investing: For those looking to grow their wealth, Albert offers accessible investment options. It simplifies the often-complex world of investing, allowing users to start with small amounts and build diversified portfolios. This feature democratizes investing, making it approachable for individuals who might otherwise feel intimidated by traditional investment platforms.

This holistic approach ensures that every facet of your financial life is covered, providing a truly integrated and powerful platform for monetary management. The convenience of having all these tools within a single app significantly enhances the user experience, making financial health more attainable than ever before.

Getting Started with Your Albert Journey: Seamless Setup

Embarking on your financial journey with Albert is designed to be as straightforward and user-friendly as possible. The developers have prioritized a seamless onboarding process, recognizing that ease of access is key to encouraging consistent engagement with financial tools. Getting started with this powerful app requires just a few simple steps, ensuring that anyone, regardless of their tech-savviness, can quickly set up their account and begin to take control of their finances. This initial simplicity is a testament to Albert's commitment to making financial management accessible to a broad audience, removing common barriers to entry.

The first step to unlocking Albert's full potential is readily available to anyone with a smartphone. "To create your Albert account, download the Albert app onto your mobile phone from the app store." Whether you're an iOS user on the Apple App Store or an Android user on Google Play, the app is just a few taps away. This universal availability ensures that the vast majority of smartphone users can easily access and integrate Albert into their daily lives. Once downloaded, the intuitive interface guides you through the rest of the setup process, making it a quick and painless experience that sets the stage for a more organized financial future.

Securing Your Financial Future: Account Security and Management

Once the Albert app is downloaded, the registration process is equally streamlined, focusing on both user convenience and robust security. "To register, open the app, enter your name, email address, and select a secure password." This standard procedure ensures that your account is uniquely identified and protected from unauthorized access. Choosing a strong, unique password is a critical first line of defense, and Albert encourages users to adopt best practices in password management to safeguard their financial information.

Beyond initial setup, Albert places a high emphasis on ongoing account security and user control. The app provides a comprehensive suite of tools for managing your "Albert account resetting your password account security updating your profile managing your notifications external overdraft reimbursement policy accessing your tax documents can I get a..." This robust management portal empowers users to maintain vigilance over their financial data and adjust settings as their needs evolve. Key aspects of account management include:

- Password Resetting: Should you forget your password or suspect a breach, the app offers a secure and straightforward process for resetting it, ensuring continuous access to your funds and financial insights.

- Account Security Monitoring: Albert employs advanced security measures, including encryption and multi-factor authentication, to protect your sensitive financial data. The app is designed with bank-level security protocols to ensure your information remains confidential and secure.

- Updating Your Profile: Keeping your personal and financial information current is crucial for the app's accuracy and for receiving relevant advice. Albert makes it easy to update your contact details, linked accounts, and other profile information.

- Managing Notifications: You have full control over the types of notifications you receive, from spending alerts to savings updates. This customization allows you to stay informed without feeling overwhelmed, tailoring the app's communication to your preferences.

- Accessing Tax Documents: For tax season, Albert simplifies the process by providing easy access to necessary tax documents directly within the app, reducing administrative burdens and ensuring you have all the information you need.

- External Overdraft Reimbursement Policy: This feature highlights Albert's commitment to protecting its users, offering policies that can help mitigate the impact of external overdrafts, demonstrating a proactive approach to user financial well-being.

These comprehensive security and management features underscore Albert's dedication to providing a safe, reliable, and user-controlled environment for managing your money. The peace of mind that comes with knowing your financial data is secure is invaluable, allowing you to focus on achieving your financial goals with confidence.

Smart Savings: High-Yield Accounts and Automated Genius

One of the standout features that truly differentiates Albert in the crowded financial app market is its intelligent approach to savings. It moves beyond simply tracking your money; it actively helps you grow it. The app understands that for many, consistent saving can be a challenge, often requiring significant discipline and manual effort. Albert addresses this head-on by integrating powerful tools designed to make saving effortless and highly rewarding, turning passive financial habits into active wealth-building strategies.

A cornerstone of Albert's savings philosophy is its commitment to maximizing your returns. Users have the opportunity to "Open a high yield savings account to earn competitive rates on your deposits, over 9x the national average." This is a significant advantage over traditional savings accounts offered by many large banks, which often provide minimal interest rates. By offering a high-yield option, Albert ensures that your money isn't just sitting idle; it's actively working for you, generating more income over time. This competitive rate helps your savings grow faster, accelerating your progress towards financial milestones like a down payment on a home, a significant purchase, or building a robust emergency fund. The power of compounding interest, even on small amounts, becomes a tangible benefit when coupled with a high-yield account, making your savings journey more impactful.

Beyond competitive interest rates, Albert introduces its innovative "Genius" feature, which revolutionizes the way people save. This intelligent system is designed to remove the friction from saving, making it an automatic and almost imperceptible part of your financial routine. "Albert analyzes your income and spending to find small amounts we think you can afford to set aside, and we move your money automatically based on your settings." This predictive analysis is incredibly powerful. Instead of you having to manually transfer funds or decide how much to save, Albert's Genius identifies micro-opportunities to save without impacting your daily lifestyle. It might be a few dollars here and there, but these small, consistent transfers accumulate rapidly over time, building a substantial savings cushion without you even noticing the deductions.

The Genius feature can be customized to fit your comfort level, allowing you to set preferences for how much and how often money is moved. This ensures that while the process is automated, you retain control over your financial boundaries. The beauty of this system lies in its ability to adapt to your financial ebb and flow, ensuring that savings transfers only occur when your budget can comfortably accommodate them. This intelligent automation fosters a habit of saving, turning it from a conscious effort into an ingrained financial behavior. It exemplifies how Albert leverages technology to provide personalized financial advice and automated solutions that genuinely improve users' financial health, moving beyond simple tracking to active financial optimization.

Navigating Your Money: Transactions and Withdrawals

Understanding and managing the flow of money in and out of your account is fundamental to financial control, and Albert provides clear, accessible tools for this purpose. The app ensures that users have full transparency and control over their funds, from making purchases to withdrawing cash. This clarity is vital for maintaining an accurate picture of your financial standing and for quickly addressing any discrepancies that may arise. Albert's commitment to user empowerment extends to every transaction, providing peace of mind and operational efficiency.

One of the most common questions for any financial platform is, "How do I withdraw money from my account?" Albert simplifies this process, offering straightforward methods to access your funds when you need them. Whether it's transferring money to an external bank account or utilizing your Albert Cash debit card at an ATM, the app provides clear instructions and support to facilitate quick and secure withdrawals. This accessibility ensures that your money is always within reach, providing liquidity and flexibility for your financial needs, whether it's for an emergency or simply daily expenses.

Furthermore, Albert understands that errors can occasionally occur with transactions, which is why it provides a clear resolution pathway. "What if I notice an error with an Albert card transaction?" The app is equipped with a dedicated support system to address such issues promptly. Users can easily report suspicious or incorrect transactions directly through the app, initiating a review process that helps protect their funds and rectify any mistakes. This proactive approach to error resolution builds trust and demonstrates Albert's commitment to safeguarding its users' financial integrity. The ability to quickly identify and report discrepancies is a critical feature for maintaining accurate financial records and preventing potential fraud.

The Albert Cash debit card plays a central role in managing your daily spending and accessing your funds. The app provides comprehensive information about its functionality, allowing users to understand its benefits and how to use it effectively. "See all 7 articles debit card what are my Albert cash debit card." These resources cover everything from how to activate your card, manage your PIN, track transactions, and understand any associated fees. The debit card integrates seamlessly with the Albert app, providing real-time updates on your spending and helping you stay within your budget. It's a practical tool that complements the app's budgeting and saving features, offering a tangible way to manage your money in the real world while benefiting from Albert's intelligent insights.

The combination of easy withdrawal options, a robust error resolution process, and a fully integrated debit card ensures that Albert users have complete control and transparency over their transactions. This comprehensive approach to money movement solidifies Albert's position as a reliable and user-centric financial management tool, giving users confidence in every financial interaction.

Beyond the Basics: Advanced Features and Support

While Albert excels at the fundamentals of budgeting, saving, and spending, its true power lies in its suite of advanced features and comprehensive support system. The app goes beyond basic transaction tracking to offer deeper insights and practical solutions for various financial needs, ensuring users are well-equipped for every stage of their financial journey. These advanced functionalities underscore Albert's commitment to being a holistic financial partner, not just a simple money tracker. They cater to a broader range of user requirements, from tax preparation to managing unexpected financial challenges, solidifying its position as a truly indispensable tool.

One such crucial feature is the ease of "accessing your tax documents." Tax season can be a stressful time, but Albert simplifies it by centralizing the necessary financial statements and documents within the app. This eliminates the need to scour through multiple bank statements or investment reports, saving users valuable time and reducing the potential for errors. By providing organized access to tax-related information, Albert streamlines a typically complex process, allowing users to prepare their taxes more efficiently and accurately. This thoughtful integration demonstrates an understanding of real-world financial demands and provides practical utility beyond daily money management.

Furthermore, Albert offers a proactive approach to financial challenges, particularly concerning unexpected expenses. The "external overdraft reimbursement policy" is a testament to the app's dedication to protecting its users from common financial pitfalls. This policy provides a safety net, helping users avoid or mitigate the impact of overdraft fees from their linked external bank accounts. It's a crucial feature that offers peace of mind, knowing that Albert is looking out for your financial well-being and is prepared to assist when unforeseen circumstances arise. This kind of protective measure elevates Albert from a mere tracking tool to a supportive financial guardian.

Beyond these specific features, Albert is designed to be an ongoing source of financial guidance and support. The app addresses "commonly asked questions" through an extensive help center, providing detailed answers and troubleshooting tips for a wide range of topics. This self-service resource empowers users to find solutions quickly and efficiently. For more personalized assistance, the "what can I ask Genius?" feature allows users to directly interact with Albert's financial experts. This human touch provides tailored advice, whether it's about investment strategies, debt management, or optimizing savings. It bridges the gap between automated insights and personalized human expertise, offering a unique blend of technology and professional guidance that truly sets Albert apart in the digital finance landscape.

These advanced features, combined with robust support, ensure that Albert is more than just a transactional app. It's a comprehensive financial ecosystem designed to empower users with knowledge, protection, and personalized assistance, helping them navigate the complexities of personal finance with confidence and ease.

Why Millions Trust Albert: A Community of Financial Empowerment

The true measure of any financial tool lies not just in its features, but in its adoption and impact on users' lives. In this regard, Albert stands as a resounding success, evidenced by the impressive milestone: "Join 10 million+ people using Albert today." This substantial user base is a powerful testament to the app's effectiveness, reliability, and the significant value it provides to a diverse range of individuals seeking better financial health. The trust placed in Albert by millions speaks volumes about its ability to deliver on its promise of simplifying and optimizing personal finance.

The rapid growth in Albert's user community isn't accidental; it's a direct result of the app's commitment to user-centric design and tangible financial benefits. People are drawn to Albert because it offers solutions to common financial pain points: the struggle to save, the confusion of budgeting, and the intimidation of investing. By addressing these challenges with intelligent automation and clear guidance, Albert has cultivated a loyal following of users who have experienced real improvements in their financial lives. This widespread adoption creates a virtuous cycle, where more users lead to more data, allowing Albert's algorithms to become even smarter and more effective in providing personalized advice.

The trust factor is further bolstered by Albert's adherence to principles of transparency and security, crucial elements for any YMYL (Your Money or Your Life) service. When individuals entrust an app with their financial data, they expect the highest standards of protection and ethical conduct. Albert meets these expectations by employing bank-level security, clear privacy policies, and a responsive customer support system. This dedication to safeguarding user information and providing reliable service builds confidence, encouraging more people to integrate Albert into their daily financial routines. The positive word-of-mouth and high user retention rates are clear indicators of this deep-seated trust.

Moreover, the community aspect of "10 million+ people using Albert today" signifies a collective movement towards financial empowerment. Users aren't just isolated individuals managing their money; they are part of a larger ecosystem benefiting from shared insights and continuous improvements to the app. This large user base also enables Albert to gather vast amounts of data (anonymized and aggregated, of course) that can be used to refine its AI-driven features, such as the Genius savings tool. The collective experience of millions helps to fine-tune the app's algorithms, making its financial advice and automated actions even more precise and beneficial for future users. This continuous improvement loop, driven by a large and engaged user community, ensures that Albert remains at the forefront of personal financial technology, consistently delivering value and fostering financial well-being for all its users.

Albert's Commitment to Your Financial Well-being

In the realm of personal finance, where decisions can profoundly impact one's life, the principles of E-E-A-T (Expertise, Experience, Authoritativeness, Trustworthiness) and YMYL (Your Money or Your Life) are paramount. Albert embodies these principles through its design, functionality, and the very core of its mission. The app is not merely a tool; it's a dedicated partner committed to enhancing your financial well-being, providing the expertise and reliable guidance necessary to navigate the complexities of modern money management.

Albert demonstrates its Expertise by leveraging sophisticated algorithms and financial intelligence to analyze complex data and provide actionable insights. The "Genius" feature, for instance, isn't just a simple automation; it's the result of extensive financial modeling and behavioral economics, designed to optimize savings without conscious effort. This deep understanding of financial principles and user behavior allows Albert to offer advice and take actions that are genuinely beneficial, reflecting a high level of specialized knowledge in personal finance.

The Experience factor is evident in Albert's intuitive user interface and seamless integration of various financial functions. The app is built with the user journey in mind, making complex tasks like budgeting, investing, and expense tracking feel effortless. The millions of users who have successfully managed their finances and achieved their goals through Albert's platform stand as a testament to its practical efficacy and positive user experience. The continuous refinement of features based on user feedback further solidifies its commitment to providing a top-tier experience.

Albert establishes its Authoritativeness by providing clear, data-driven insights and offering features like high-yield savings accounts that are genuinely competitive and beneficial. The app's ability to consolidate diverse financial information and present it in an understandable format positions it as a reliable source of financial truth for its users. When Albert suggests a saving amount or highlights a spending category, it does so based on comprehensive analysis, lending authority to its recommendations. Furthermore, the availability of human financial experts through the "Genius" feature adds another layer of authoritative guidance.

Finally, Trustworthiness is the bedrock of Albert's operation. In the YMYL category, trust is non-negotiable. Albert ensures this through robust security measures, transparent policies regarding data usage and privacy, and a responsive customer support system that addresses concerns promptly. Features like the external overdraft reimbursement policy and clear guidelines on debit card transactions further build confidence, demonstrating that Albert is committed to protecting its users' financial interests. The consistent positive feedback from its vast user base reinforces this trust, making Albert a reliable choice for anyone looking to improve their financial health.

By embodying E-E-A-T principles, Albert doesn't just offer financial tools; it provides a trustworthy and authoritative platform that empowers users to make informed decisions about their money, directly impacting their financial stability and overall quality of life. This commitment to user well-being is what truly sets Albert apart as a leader in personal finance technology.

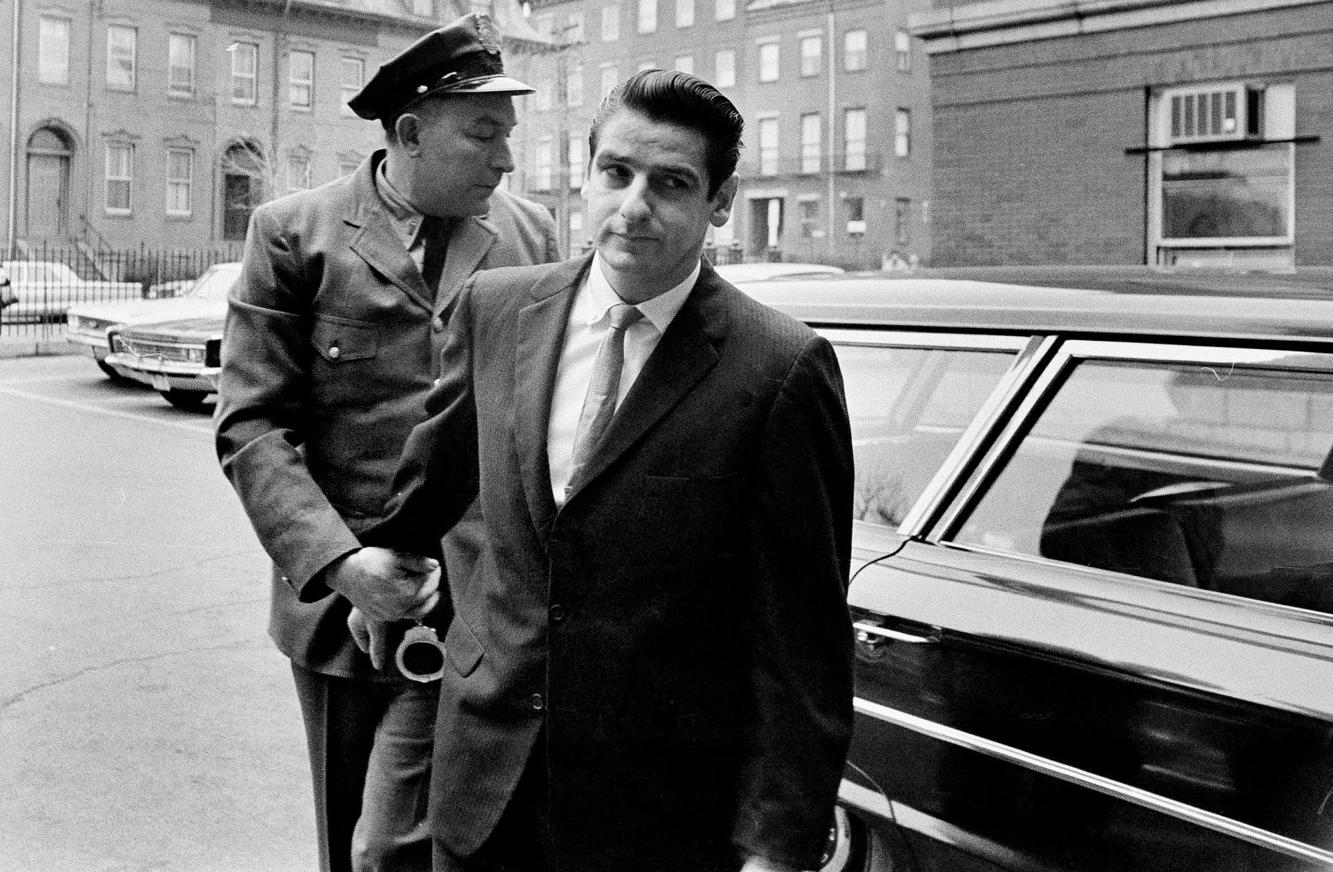

Albert DeSalvo

:max_bytes(150000):strip_icc():focal(734x569:736x571)/Boston-Strangler-Albert-DeSalvo-02-fcadb566c840456fa9aa0281b167fad8.jpg)

Boston Strangler True Story: What to Know About the Hulu Film

/GettyImages-514875142-58dc99025f9b584683f3f4e4.jpg)

Albert Desalvo va confessar ser l’estrangulador de Boston, però ho era?