Albert: Unlocking Your Financial Potential With A Powerful App

Table of Contents

- Introduction

- The Genesis of Financial Empowerment: Understanding Albert

- Budgeting and Smart Savings Made Easy with Albert

- Unlocking Early Access: Albert's Paycheck & Cash Features

- Investing and Protecting Your Future Through Albert

- Navigating Your Albert Account: Security and Support

- Albert's Genius: Personalized Financial Advice

- Expanding Your Reach: The Albert Referral Program

- Why Albert Stands Out in the Financial Landscape

- Conclusion

Introduction

In an era where managing personal finances can feel overwhelming, a revolutionary tool has emerged to simplify the journey: Albert. This isn't just another budgeting app; Albert is a comprehensive financial companion designed to empower millions to take control of their money, offering a seamless experience for budgeting, saving, spending, and investing, all within one incredibly powerful application.

With over 10 million people already leveraging its capabilities, Albert stands as a testament to effective financial technology. Whether you're looking to optimize your daily spending, build a robust savings plan, or explore investment opportunities, Albert provides the tools and insights you need to achieve your financial goals, transforming complex financial tasks into manageable, everyday actions.

The Genesis of Financial Empowerment: Understanding Albert

In today's fast-paced world, financial well-being is paramount, yet often elusive for many. The sheer volume of financial decisions—from daily spending to long-term investments—can be daunting. This is where Albert steps in, not merely as an application but as a holistic financial ecosystem. Its core mission is to democratize financial expertise, making sophisticated money management accessible to everyone, regardless of their financial background or current situation.

Albert is meticulously designed to serve as your personal financial guide, consolidating various aspects of your financial life into a single, intuitive platform. It moves beyond basic tracking, offering proactive insights and personalized advice that adapt to your unique financial habits and aspirations. The platform's commitment to user empowerment is evident in its user-friendly interface and the breadth of services it offers, all aimed at fostering healthier financial habits and achieving tangible financial progress.

It's crucial to understand the fundamental nature of this powerful tool: Albert is not a bank. This distinction is vital for clarity and trust. Instead, banking services are provided by Albert’s trusted bank partners. This collaborative model ensures that while Albert focuses on delivering cutting-edge financial management tools and insights, the underlying banking infrastructure remains secure, regulated, and reliable, adhering to industry standards for financial security and consumer protection. This partnership model allows Albert to innovate rapidly in the fintech space while relying on established financial institutions for core banking functionalities, offering users the best of both worlds: agile technology and robust financial security.

Budgeting and Smart Savings Made Easy with Albert

Effective budgeting is the cornerstone of financial stability, and Albert excels in making this often-dudgy task simple and insightful. The app provides a clear, real-time overview of your income and expenses, helping you understand exactly where your money goes. This transparency is the first step towards taking control of your finances with Albert.

Beyond simple tracking, Albert offers intelligent budgeting features that help you set realistic spending limits and identify areas where you can save. It categorizes your transactions automatically, making it easy to see your spending patterns at a glance. This proactive approach to budgeting allows users to make informed decisions, curb unnecessary expenses, and allocate funds more effectively towards their financial goals.

Saving money can often feel like an uphill battle, but Albert transforms it into an effortless habit. The app's automated savings feature intelligently analyzes your income and spending, then moves small, affordable amounts into your savings account without you even noticing. This "set it and forget it" approach ensures consistent growth in your savings, building a safety net or funding future aspirations without requiring constant manual effort. This intelligent automation is a key reason why millions trust Albert to help them build their financial future.

Unlocking Instant Advances: How Albert Helps

Life often throws unexpected expenses our way, and sometimes, a little extra cash can make all the difference. Albert understands this reality and offers a unique feature: instant advances. This service is designed to provide a financial cushion when you need it most, helping you avoid overdraft fees or late payment penalties.

To get started with Albert advances, the process is straightforward and user-friendly. Simply head to the home screen in the app or online and tap 'Instant'. Follow the prompts to set up Instant, and Albert will guide you through the process. This feature is a testament to Albert's commitment to providing practical, immediate solutions for its users' financial needs. It’s an innovative way to bridge temporary cash flow gaps, ensuring you stay on track with your financial commitments without resorting to high-interest loans.

Moreover, Albert sweetens the deal for new users and referrals. For every friend you invite to Albert, they’ll get access to advance $50 with Instant when they join Albert and set up Albert. This not only encourages wider adoption of responsible financial habits but also provides immediate tangible benefits to new users, making the initial step into financial management even more appealing.

Unlocking Early Access: Albert's Paycheck & Cash Features

Waiting for payday can be a source of stress, especially when bills are due or unexpected expenses arise. Albert addresses this common pain point by offering features that provide earlier access to your funds, enhancing your financial flexibility and reducing stress.

One of the standout features is the ability to get your paycheck up to 2 days early with direct deposit. This can be a game-changer for many, allowing them to pay bills on time, avoid late fees, and manage their cash flow more effectively. This early access to funds is a significant benefit, providing peace of mind and greater control over your finances. It's a prime example of how Albert is designed to align with the real-world financial needs of its users, offering practical solutions that make a tangible difference.

In addition to early paycheck access, Albert also facilitates easy access to physical cash. You can cash a debit card with cash back, providing a convenient way to get the cash you need without extra trips or fees. This feature, combined with the early direct deposit, underscores Albert's comprehensive approach to liquidity management, ensuring users have access to their money in the format they need, when they need it.

Investing and Protecting Your Future Through Albert

Beyond daily money management, Albert empowers users to build long-term wealth through accessible investing tools. For many, investing seems complex and out of reach, but Albert simplifies the process, making it approachable for beginners while offering options for more experienced users. The app provides guided investing options, allowing users to start with small amounts and grow their portfolios over time, aligning with their financial goals and risk tolerance. This focus on making investing easy and intuitive is a key differentiator for Albert, helping more people participate in wealth creation.

Protecting your financial future also involves understanding and managing potential risks. While the provided data mentions "protect advice," this broadly encompasses Albert's commitment to financial literacy and security. Albert helps users understand concepts like external overdraft reimbursement policy, ensuring they are aware of how to protect themselves from common financial pitfalls. By offering clear explanations and proactive alerts, Albert acts as a vigilant guardian of your financial well-being, helping you navigate potential challenges and make informed decisions.

Navigating Your Albert Account: Security and Support

Managing your financial accounts requires robust security and readily available support. Albert prioritizes both, ensuring that users feel confident and secure while using the app, and can quickly find answers or assistance when needed. A well-managed account is the foundation of effective financial planning, and Albert provides the tools and resources to maintain it.

Account Security and Management

Your Albert account is designed with security in mind. Features like resetting your password, understanding account security protocols, updating your profile, and managing your notifications are all built to be user-friendly yet robust. Albert emphasizes the importance of strong passwords and offers clear guidance on how to maintain the security of your financial information. Regular updates to your profile ensure that your financial advice and services are always tailored to your current situation, while customizable notifications keep you informed about your account activity without overwhelming you.

Understanding policies like the external overdraft reimbursement policy is also crucial. Albert aims to educate users on these important aspects of financial management, empowering them to make smart choices and avoid unnecessary fees. The platform's commitment to transparency in these areas builds trust and helps users feel more in control of their financial journey.

How to Contact Albert for Immediate Answers

Even with the most intuitive app, questions can arise. Albert ensures that help is always within reach. For immediate answers to common questions, users are encouraged to check out Albert's comprehensive help center. This resource is packed with information covering a wide range of topics, from the basics of budgeting and cash management to instant savings, investing, and general financial advice. It also addresses frequently asked questions about resetting your password, getting set up, and what you can ask Albert's "Genius" feature.

The help center is designed to be a self-service hub, allowing users to quickly find solutions at their own convenience. This efficient support system is vital for maintaining user satisfaction and ensuring that financial management remains a smooth and stress-free experience with Albert.

Albert's Genius: Personalized Financial Advice

One of Albert's most distinctive and valuable features is its "Genius" service. This isn't just an automated chatbot; it's a personalized financial advisory service that connects you with human financial experts who can provide tailored advice. The Genius feature is designed to answer complex questions and offer strategic guidance that goes beyond what an algorithm can provide.

Users can ask Genius a wide array of questions, covering topics such as optimizing their budget, understanding investment options, managing debt, or planning for major life events. This human touch ensures that the advice you receive is nuanced, empathetic, and truly relevant to your unique financial circumstances. It transforms Albert from a mere tool into a genuine financial partner, providing the expertise and confidence needed to make significant financial strides. This personalized advice elevates Albert above many other financial apps, offering a level of support typically reserved for high-net-worth individuals.

Expanding Your Reach: The Albert Referral Program

Albert believes in the power of shared financial well-being, and its referral program is a testament to this philosophy. The program is designed to spread the word about Albert's benefits, encouraging existing users to invite friends and family to join the platform. This not only helps more people gain control over their finances but also provides tangible benefits for both the referrer and the new user.

The incentive is clear and immediate: for every friend you invite to Albert, they’ll get access to advance $50 with Instant when they join Albert and set up their account. This provides a compelling reason for new users to get started, offering them an immediate financial boost while they begin their journey with Albert. It's a win-win situation that fosters community and encourages widespread adoption of smart financial practices. This program is a smart way to grow the Albert community, leveraging the trust and satisfaction of its existing user base.

Why Albert Stands Out in the Financial Landscape

In a crowded market of financial applications, Albert distinguishes itself through a combination of comprehensive features, user-centric design, and a commitment to personalized support. Its ability to integrate budgeting, saving, spending, and investing into a single, powerful app simplifies financial management, removing the need for multiple platforms.

The emphasis on early access to funds through direct deposit and instant advances addresses immediate financial needs, providing crucial flexibility. The intelligent automation of savings, coupled with the human touch of Albert's Genius advisors, creates a balanced approach that caters to both routine financial tasks and complex strategic planning. Furthermore, the transparent communication regarding its non-bank status and partnerships with regulated financial institutions builds a strong foundation of trust, crucial for any YMYL (Your Money Your Life) service.

Albert isn't just about managing money; it's about empowering individuals to build a more secure and prosperous future. By making sophisticated financial tools accessible and understandable, Albert is helping millions achieve their financial aspirations, proving itself to be an indispensable ally in the journey towards financial freedom.

Conclusion

In summary, Albert represents a significant leap forward in personal financial management. From its intuitive budgeting and automated savings to its innovative instant advances and early paycheck features, Albert provides a robust suite of tools designed to simplify and optimize your financial life. The personalized advice offered by Albert's Genius, combined with its secure banking partnerships, ensures that users receive both cutting-edge technology and trustworthy guidance.

With over 10 million users already experiencing its benefits, Albert has proven its efficacy in helping individuals take control of their finances, make smarter spending decisions, and build a solid foundation for their future. If you're looking for a comprehensive, user-friendly, and powerful app to navigate the complexities of your money, Albert offers an all-in-one solution that truly empowers your financial journey. Take control of your finances with Albert today and join a community dedicated to achieving financial well-being.

Ready to transform your financial habits? Explore the Albert app and discover how it can help you budget, save, spend, and invest more intelligently. Share your experiences in the comments below, or consider inviting a friend to unlock their financial potential with Albert!

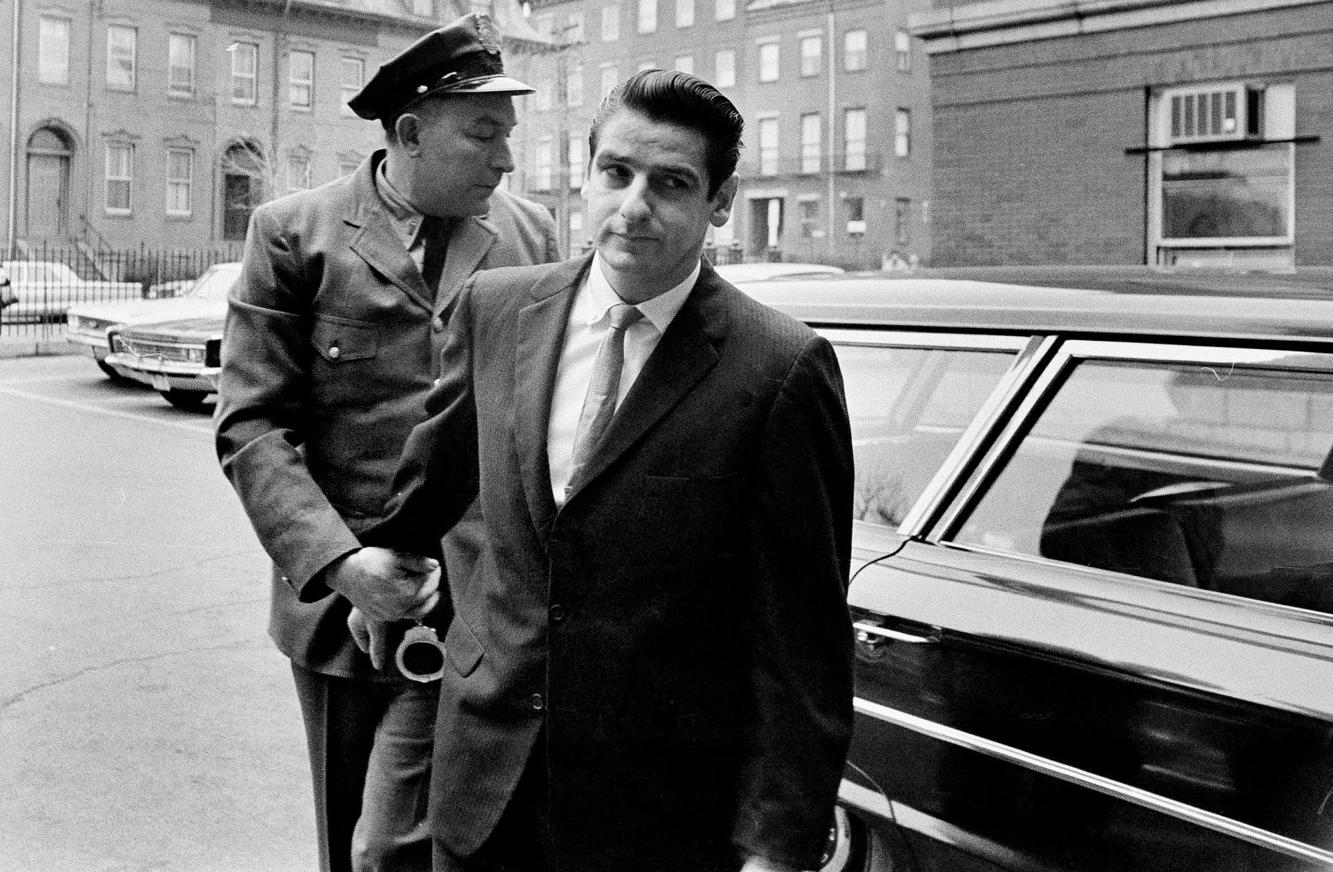

Albert DeSalvo

:max_bytes(150000):strip_icc():focal(734x569:736x571)/Boston-Strangler-Albert-DeSalvo-02-fcadb566c840456fa9aa0281b167fad8.jpg)

Boston Strangler True Story: What to Know About the Hulu Film

/GettyImages-514875142-58dc99025f9b584683f3f4e4.jpg)

Albert Desalvo va confessar ser l’estrangulador de Boston, però ho era?