Morgan Metzer's Journey: Mastering Wealth With Strategic Insights

The Morgan Metzer Story is a compelling narrative of financial empowerment and strategic wealth management in an increasingly complex world. It's a testament to how proactive planning, coupled with access to robust financial tools and expert guidance, can transform aspirations into tangible achievements. This journey isn't just about accumulating wealth; it's about building a resilient financial future, making informed decisions, and leveraging every available resource to navigate the ever-shifting economic landscape.

In today's fast-paced financial environment, individuals are constantly seeking ways to optimize their investments, manage daily finances, and secure their long-term goals. The story of Morgan Metzer, while a composite representation of many successful individuals, perfectly encapsulates the modern approach to financial mastery. It highlights the critical role that comprehensive financial platforms play in providing the clarity, control, and confidence needed to thrive.

Table of Contents

- Unveiling the Morgan Metzer Story: A Vision for Financial Mastery

- The Foundation: Seamless Wealth Management with Morgan Stanley Online

- The Power of Mobile: Morgan Stanley App for On-the-Go Control

- Beyond Personal Finances: Leveraging Morgan Stanley at Work and Morgan Access®

- Global Reach and Professional Tools: Morgan Access for Treasury & Investment

- Strategic Partnerships: Morgan Stanley's Role in the Global Financial Landscape

- Expert Guidance: Navigating Volatility and Achieving Financial Goals

- Comprehensive Financial Ecosystem: Investment Banking to Asset Management

- The Enduring Legacy of the Morgan Metzer Story: A Blueprint for Success

Unveiling the Morgan Metzer Story: A Vision for Financial Mastery

The Morgan Metzer Story isn't about a single individual's specific personal details, but rather a compelling illustration of how ambitious professionals and discerning investors navigate the complexities of modern finance. Morgan Metzer represents the archetype of someone who understands that true financial mastery isn't just about earning more, but about managing intelligently, investing strategically, and having access to the right resources. This narrative emphasizes the journey from financial awareness to active management, showcasing how a well-structured approach can lead to significant personal and professional growth.

At the heart of the Morgan Metzer approach is the recognition that financial success in the 21st century demands more than just traditional banking. It requires an integrated ecosystem where personal investments, everyday finances, and professional benefits converge. This holistic view allows for a clearer picture of one's financial standing, enabling better decision-making and a more confident path towards long-term objectives. The story underscores the importance of choosing a financial partner that offers not just services, but a comprehensive suite of tools and expert insights designed for the modern investor.

The Foundation: Seamless Wealth Management with Morgan Stanley Online

For Morgan Metzer, the cornerstone of effective financial management began with a robust online platform. The ability to centralize and oversee all financial activities from a single, secure location was paramount. This is precisely where the capabilities of a sophisticated online wealth management site come into play. To seamlessly and securely manage investments and everyday finances in one place is not merely a convenience; it is a strategic advantage. Imagine logging in to a platform where your investment portfolio, savings accounts, checking accounts, and even credit lines are all accessible through a unified interface. This eliminates the need to juggle multiple logins and provides an immediate, comprehensive overview of one's financial health.

The security aspect of such a platform cannot be overstated. In an age where cyber threats are constant, knowing that your sensitive financial data is protected by industry-leading security protocols provides immense peace of mind. For Morgan Metzer, this meant being able to confidently review account balances, execute trades, transfer funds, and analyze portfolio performance without concern. This level of integrated, secure access is fundamental to modern wealth management, allowing individuals to stay agile and responsive to market changes and personal financial needs.

The Power of Mobile: Morgan Stanley App for On-the-Go Control

Complementing the online portal, the mobile application became an indispensable tool in the Morgan Metzer Story. The ability to download the Morgan Stanley online app to access an account, manage finances, and discover a wealth of tools for budgeting, bill pay, and more, transformed financial management into an on-the-go activity. In today's dynamic world, decisions often need to be made quickly, and opportunities can arise unexpectedly. A mobile app that provides real-time access to financial data and transactional capabilities ensures that one is always in control, regardless of location.

The utility of such an app extends far beyond just checking balances. Features like budgeting tools allow for meticulous tracking of expenses and income, fostering financial discipline. Bill pay functionalities ensure that commitments are met promptly, avoiding late fees and maintaining a strong credit profile. Furthermore, the ability to receive real-time alerts and notifications about market movements or account activity empowers users like Morgan Metzer to react swiftly to changes, whether it's rebalancing a portfolio or identifying potential fraud. This mobile accessibility is crucial for maintaining financial agility and staying connected to one's wealth management strategy at all times.

Beyond Personal Finances: Leveraging Morgan Stanley at Work and Morgan Access®

The Morgan Metzer Story also illustrates the sophisticated integration of personal wealth management with workplace financial benefits. For many professionals, a significant portion of their financial planning involves understanding and maximizing their employer-sponsored programs. The ability to log in to manage a Morgan Stanley at Work account and access workplace financial benefits streamlines this crucial aspect of financial life. This includes everything from retirement plans like 401(k)s, stock options, and employee stock purchase plans, to health savings accounts and other benefits that contribute significantly to overall financial well-being. Consolidating these under one umbrella simplifies oversight and allows for a more cohesive financial strategy.

Furthermore, for professionals with more complex financial needs, especially those in corporate or institutional roles, Morgan Access® provides an elevated level of functionality. The phrase "Morgan Access® log in with your credentials" signifies entry into a highly specialized portal designed for treasury and investment professionals. This is not just about personal banking; it's about managing significant corporate funds, executing large-scale transactions, and accessing sophisticated financial instruments. For someone like Morgan Metzer, who might be involved in corporate finance or managing substantial assets, this level of access is indispensable for professional duties and strategic financial operations.

Global Reach and Professional Tools: Morgan Access for Treasury & Investment

Delving deeper into the professional sphere, Morgan Access provides treasury and investment professionals across the globe with a secure gateway to a wide range of financial transactions and account information, including trust. This highlights the global reach and advanced capabilities that underpin the broader Morgan Stanley ecosystem. For Morgan Metzer, in a professional capacity, this means having the tools to manage intricate financial structures, oversee international transactions, and access detailed trust information with unparalleled security and efficiency. This platform is designed to meet the rigorous demands of institutional finance, offering robust reporting, real-time data, and secure communication channels.

The inclusion of "trust" in this context is particularly telling, indicating the platform's capacity to handle complex fiduciary responsibilities and wealth transfer strategies. This level of sophistication is crucial for large corporations, institutional investors, and high-net-worth individuals who require comprehensive solutions for managing significant and often multi-jurisdictional assets. The secure gateway aspect ensures that sensitive financial operations are protected, maintaining the integrity and confidentiality of critical data, which is a cornerstone of trust in the financial industry.

Strategic Partnerships: Morgan Stanley's Role in the Global Financial Landscape

The success embedded in the Morgan Metzer Story is also a reflection of the strength and reliability of the underlying financial institution. Morgan is a leader in wholesale financial services, serving one of the largest client franchises in the world. This statement underscores the immense scale and influence of Morgan Stanley in the global financial arena. Being a leader in wholesale services means providing critical financial infrastructure and solutions to other financial institutions, corporations, and governments. This foundational strength trickles down, providing stability and advanced capabilities to individual clients like Morgan Metzer.

The breadth of clients served by Morgan Stanley is extensive: Our clients include corporations, institutional investors, hedge funds. This diverse client base speaks to the institution's versatility and its deep understanding of various market segments. Working with such a wide array of sophisticated clients means that Morgan Stanley is at the forefront of financial innovation and market intelligence. This expertise, honed through serving some of the most demanding financial entities, directly benefits individual wealth management clients by providing access to cutting-edge strategies, robust research, and a highly experienced team of professionals. The sheer volume and complexity of the transactions handled by such an institution ensure a level of expertise and market insight that is invaluable.

Expert Guidance: Navigating Volatility and Achieving Financial Goals

A critical element of the Morgan Metzer Story is the emphasis on continuous learning and expert guidance. Financial markets are inherently dynamic, influenced by a myriad of factors. To learn from industry leaders about how to manage wealth and help meet personal financial goals is an unparalleled advantage. This isn't just about receiving generic advice; it's about gaining insights from professionals who are deeply immersed in market trends, economic indicators, and geopolitical shifts. These insights are crucial for making informed investment decisions and adapting strategies as circumstances evolve.

The ability to stay informed on critical global factors is vital: From volatility and geopolitics to economic trends and investment outlooks, stay. This continuous flow of curated information and expert analysis empowers individuals like Morgan Metzer to understand the broader context impacting their investments. In times of market volatility, having access to clear, concise explanations from trusted sources can prevent panic-driven decisions and help maintain a long-term perspective. This expert guidance is not just reactive; it's proactive, helping clients anticipate potential challenges and opportunities, thereby optimizing their path towards achieving their personal financial goals.

Comprehensive Financial Ecosystem: Investment Banking to Asset Management

The comprehensive nature of Morgan Stanley's offerings forms the backbone of the success depicted in the Morgan Metzer Story. Morgan is a leader in investment banking, commercial banking, financial transaction processing and asset management. This broad spectrum of services means that the institution can cater to virtually every financial need, from the most basic to the most complex. Investment banking, for instance, involves advising corporations on mergers, acquisitions, and capital raising, activities that shape industries and create wealth. Commercial banking supports businesses with their day-to-day operational needs, while financial transaction processing ensures the smooth flow of money across the globe.

Asset management, on the other hand, directly impacts individuals and institutions by managing investment portfolios to achieve specific financial objectives. The fact that Morgan Stanley excels in all these areas signifies a deeply integrated and robust financial ecosystem. We serve millions of customers, predominantly in. This vast client base, spanning individuals, corporations, and institutions, further solidifies the institution's position as a pillar of the global financial system. For Morgan Metzer, this translates into access to a vast network of resources, expertise, and opportunities that might otherwise be out of reach, ensuring that their financial journey is supported by a world-class institution.

The Enduring Legacy of the Morgan Metzer Story: A Blueprint for Success

The enduring legacy of the Morgan Metzer Story is not just about achieving financial success, but about establishing a sustainable blueprint for it. It's a narrative that underscores the power of informed choices, strategic partnerships, and leveraging cutting-edge technology in personal finance. Morgan Metzer's journey illustrates that mastering one's financial destiny in the modern era requires more than just good intentions; it demands proactive engagement with comprehensive tools and expert insights. The ability to manage money and online finances with Morgan Stanley Online and the Morgan Stanley Mobile App provides the foundational control necessary for this mastery. Discover more about our online wealth management capabilities and how they can transform your financial approach.

This story is a powerful reminder that financial well-being is an ongoing journey, not a destination. It involves continuous learning, adapting to market changes, and consistently evaluating one's financial strategy. By embracing the integrated solutions offered by leading financial institutions, individuals can gain the clarity, confidence, and control needed to navigate their unique financial paths successfully. The principles exemplified by Morgan Metzer – informed decision-making, secure access to accounts, leveraging professional tools, and seeking expert guidance – are universal keys to unlocking one's full financial potential.

Conclusion

The Morgan Metzer Story serves as an inspiring example of how modern financial tools and expert guidance can empower individuals to take charge of their financial future. From the convenience of managing everyday finances and investments through secure online portals and mobile apps, to accessing sophisticated workplace benefits and professional treasury services, the narrative highlights the transformative impact of integrated wealth management solutions. It underscores the importance of learning from industry leaders, staying informed about global economic trends, and leveraging the comprehensive capabilities of a leading financial institution that excels across investment banking, commercial banking, and asset management.

If the journey of Morgan Metzer resonates with your own financial aspirations, consider exploring how robust financial platforms can support your goals. Take the first step towards a more empowered financial future by investigating the wealth of tools available for budgeting, bill pay, and comprehensive investment management. Share your thoughts in the comments below on how you approach your financial planning, or explore other articles on our site for more insights into mastering your personal economy.

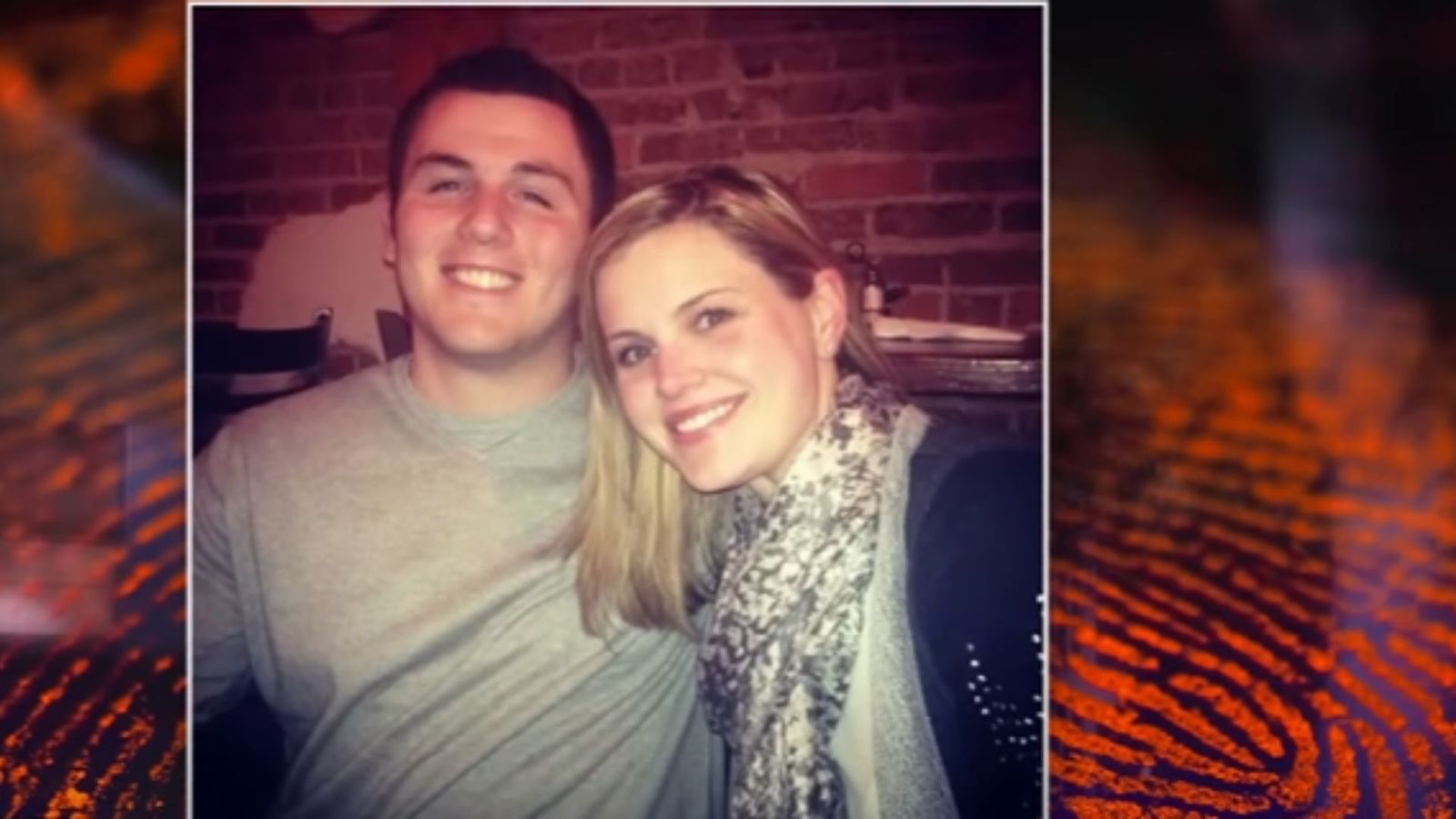

5 chilling facts about Morgan Metzer's home intrusion case, explored as

5 chilling facts about Morgan Metzer's home intrusion case, explored as

Gaslit by My Husband: The Morgan Metzer Story (2024)