Unlock Credit Clarity: Your Guide To Credit One Chat

Table of Contents

- Understanding Your Financial Lifeline: The Role of Credit

- Navigating Customer Support: What is Credit One Chat?

- The Power of Digital Assistance: Benefits of Using Credit One Chat

- How to Access and Effectively Use Credit One Chat

- Beyond Basic Queries: Advanced Uses of Credit One Chat

- Credit One Chat and Your Credit Health: A Deeper Look

- Troubleshooting Common Issues with Credit One Chat

- Maximizing Your Credit Journey: Integrating Credit One Chat with Broader Financial Tools

- Conclusion: Empowering Your Financial Future

Understanding Your Financial Lifeline: The Role of Credit

**In today's complex financial landscape, understanding and managing your credit is more crucial than ever. From securing a loan to renting an apartment, your credit profile acts as a powerful determinant of your financial opportunities.** It's a system built on trust, where a borrower receives something of value immediately and agrees to pay for it later, usually with interest. This fundamental concept underpins everything from credit cards to mortgages, making it a cornerstone of modern economic life. Without a clear grasp of how credit works, individuals can find themselves at a significant disadvantage, missing out on opportunities or incurring unnecessary costs. We hear a lot about credit – credit reports, credit scores, credit freezes, credit monitoring. What does it all mean for you? These terms, while seemingly technical, are simply different facets of your financial reputation. Your credit report, for instance, is a detailed history of your borrowing and repayment activities, compiled by major credit bureaus like Equifax, Experian, and TransUnion. Your credit score, on the other hand, is a numerical representation derived from this report, indicating your creditworthiness. Both are dynamic, constantly evolving based on your financial behavior. Tools like free weekly online credit reports available from Equifax, Experian, and TransUnion, alongside services offering free credit monitoring, alerts, and personalized offers, are designed to empower you to take control. Experian is committed to helping you protect, understand, and improve your credit, often starting with your free Experian credit report and FICO® score. Similarly, Intuit Credit Karma offers personalized recommendations, tools, and insights to help you optimize your money and grow it faster, helping you get ahead. In this comprehensive guide, we'll explore how modern communication channels, specifically **Credit One Chat**, can play a vital role in managing your credit journey effectively.Navigating Customer Support: What is Credit One Chat?

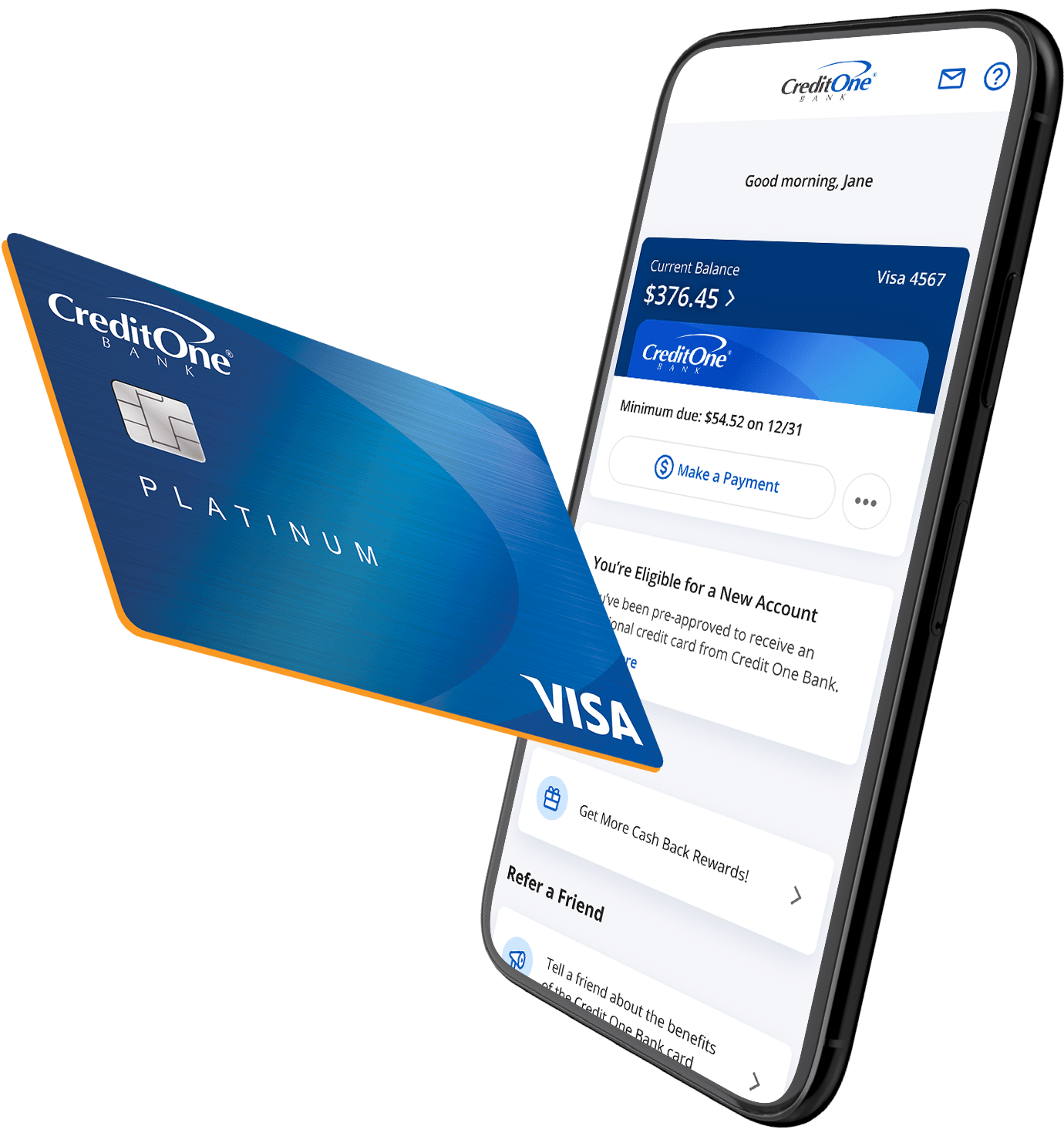

In an era where digital interaction is king, financial institutions are increasingly leveraging online platforms to provide customer support. **Credit One Chat** is a prime example of this evolution, offering a direct, text-based communication channel for Credit One Bank cardholders to interact with customer service representatives. Instead of enduring lengthy phone calls or waiting for email responses, this chat feature provides an immediate and convenient way to get answers to your questions, resolve issues, and manage your Credit One account. It’s designed to streamline the support process, making it more accessible and less time-consuming for users. This service acts as a virtual bridge between you and Credit One Bank, allowing for real-time assistance on a variety of topics related to your credit card account. Whether you have a quick question about your statement, need to clarify a transaction, or require assistance with managing your account settings, **Credit One Chat** aims to provide a responsive and efficient solution. It represents a commitment to modern customer service, acknowledging that cardholders often prefer the immediacy and written record that a chat interface provides over traditional communication methods. Understanding how to effectively utilize this tool can significantly enhance your experience as a Credit One cardholder and contribute to better overall credit management.The Power of Digital Assistance: Benefits of Using Credit One Chat

The shift towards digital customer service channels like **Credit One Chat** isn't just about convenience; it offers a multitude of tangible benefits that can significantly improve a cardholder's experience and financial management. In a world where time is a precious commodity, the ability to get quick, reliable answers without significant effort is invaluable. This digital conduit empowers users to take more proactive control over their credit accounts.Efficiency and Convenience

One of the most immediate advantages of using **Credit One Chat** is the unparalleled efficiency and convenience it offers. Unlike phone calls that often involve navigating automated menus and waiting on hold, a chat session can typically be initiated within seconds. You can often multitask while chatting, making it an ideal solution for busy individuals. This means you can address your credit card queries from almost anywhere, whether you're at home, at work, or on the go, as long as you have an internet connection. The asynchronous nature of some chat platforms also allows for a degree of flexibility, where you might not need to be glued to the screen for the entire duration of the conversation, receiving notifications when a representative responds. This ease of access encourages more frequent engagement with your account, fostering better financial habits.Personalized Support

While automated systems can handle basic queries, **Credit One Chat** connects you with a live representative who can offer personalized support tailored to your specific account and situation. This human touch is crucial for addressing complex issues that require nuance and understanding, going beyond generic FAQs. A representative can access your account details (with proper verification) and provide information that is directly relevant to your credit card, helping you understand specific transactions, clarify billing cycles, or discuss payment options. This personalized interaction helps build trust and ensures that you receive accurate and context-specific guidance, which is vital when dealing with financial matters. This level of dedicated assistance ensures that your unique questions are answered thoroughly, preventing misunderstandings and empowering you with precise information.How to Access and Effectively Use Credit One Chat

Accessing **Credit One Chat** is typically a straightforward process, designed to be user-friendly for all cardholders. The primary method for initiating a chat session is usually through the official Credit One Bank website or their dedicated mobile application. On the website, look for a "Contact Us," "Support," or "Chat" icon, often located in the footer, header, or within a dedicated customer service section. Similarly, within the mobile app, these options are usually prominently displayed within the main menu or a help section. Once you locate the chat feature, you'll likely be prompted to provide some basic information to verify your identity, such as your account number or the last four digits of your Social Security Number, for security purposes. This step is crucial for protecting your personal financial information. After verification, you'll be connected to a customer service representative. To make the most of your chat session, be prepared with your questions or issues clearly articulated. Having relevant details like transaction dates, amounts, or statement periods readily available will help the representative assist you more efficiently. Remember to be polite and concise in your communication, and don't hesitate to ask for clarification if something isn't clear. Many chat interfaces also offer the option to save or email a transcript of your conversation, which can be incredibly useful for your records, providing a documented history of your interactions and resolutions. This documentation can be invaluable for future reference or if further follow-up is required.Beyond Basic Queries: Advanced Uses of Credit One Chat

While **Credit One Chat** is excellent for handling routine inquiries like checking your balance or recent transactions, its utility extends far beyond these basic functions. Savvy cardholders can leverage this tool for more complex and strategic aspects of their financial management. For instance, you might use the chat to inquire about the specifics of your credit card's rewards program, understanding how to maximize your points or cashback. You could also discuss options for payment arrangements if you anticipate difficulty meeting a due date, or explore possibilities for a credit limit increase. While a chat agent might not be able to approve a credit limit increase on the spot, they can guide you through the application process or explain the criteria. Furthermore, **Credit One Chat** can be a valuable resource for understanding specific charges on your statement that seem unfamiliar or incorrect. Instead of simply disputing a charge, you can chat with a representative to gain clarity, potentially avoiding an unnecessary dispute if the charge is legitimate but simply misremembered. You can also use it to update personal information, set up account alerts, or even inquire about closing an account. For those looking to optimize their money and grow it faster, as suggested by Intuit Credit Karma's approach to personalized recommendations, using **Credit One Chat** to understand your Credit One card's features and how they integrate with your overall financial strategy is a smart move. This proactive engagement allows you to manage your account more effectively and make informed decisions that contribute to your financial well-being.Credit One Chat and Your Credit Health: A Deeper Look

Your Credit One card, like any other credit product, plays a significant role in your overall credit health. Understanding this connection and leveraging tools like **Credit One Chat** to manage it is crucial. While the chat service itself doesn't directly impact your credit score or report, it serves as a vital conduit for managing your account, which *does* have a direct impact. Regular and effective communication with your credit card issuer is a component of responsible financial stewardship.Inquiries About Credit Reporting

One of the most important aspects of credit health is your credit report. We hear a lot about credit reports, and for good reason: they play an important role in your financial life, and we encourage you to regularly check them. While Credit One Chat cannot directly modify your credit report with Equifax, Experian, or TransUnion, it can be instrumental in addressing discrepancies related to your Credit One account. If you've reviewed your free weekly online credit reports and noticed an error or an unfamiliar entry pertaining to your Credit One card, you can use **Credit One Chat** to inquire about it. The representative can verify the information on their end, clarify reporting practices, or guide you on the process of disputing an error with the credit bureaus if the information reported by Credit One is indeed incorrect. This proactive approach ensures the accuracy of your credit file, which is fundamental to maintaining a healthy credit score.Understanding Account Impact on Scores

Your Credit One card's activity directly influences your credit score through factors like payment history, credit utilization, and average age of accounts. You might use **Credit One Chat** to understand how certain actions, such as a large purchase or a balance transfer, might affect your credit utilization ratio. While a representative won't be able to predict your exact score change, they can explain how Credit One reports your account activity to the credit bureaus and how that data is typically interpreted. This insight, combined with the personalized recommendations and insights from services like Credit Karma that help you optimize your money, can empower you to make more informed decisions about your spending and repayment strategies, ultimately contributing to a better credit score. Experian is committed to helping you protect, understand, and improve your credit, and understanding your Credit One account's impact through direct communication is a key part of that process.Troubleshooting Common Issues with Credit One Chat

While **Credit One Chat** offers significant advantages, users might occasionally encounter minor technical glitches or common issues. Understanding how to troubleshoot these can ensure a smoother and more productive experience. One frequent issue is a sudden disconnection from the chat session. This can often be resolved by simply refreshing your browser page or restarting the mobile app. Ensure you have a stable internet connection, as a weak signal can interrupt the chat. Another common scenario is a delay in response from the representative. While chat is generally quicker than phone calls, peak hours or complex inquiries might lead to longer wait times. If you experience a significant delay, resist the urge to close the window immediately; the representative might still be typing or researching your query. If the delay is excessive, you might receive a prompt to leave a message or try again later. Sometimes, users might find that their specific issue cannot be fully resolved via chat, especially if it requires sensitive information or a more in-depth investigation. In such cases, the chat representative will usually advise you to call a specific department or provide an alternative contact method. It's important to remember that while **Credit One Chat** is a powerful tool, it's part of a broader customer service ecosystem, and sometimes a different channel might be more appropriate for certain complex or highly sensitive matters. Being patient and understanding the limitations of the platform will help you navigate these situations effectively.Maximizing Your Credit Journey: Integrating Credit One Chat with Broader Financial Tools

To truly maximize your financial well-being and credit health, it's essential to view tools like **Credit One Chat** not in isolation, but as part of a larger ecosystem of financial management resources. Your Credit One card is one piece of your financial puzzle, and effectively managing it through chat complements the insights gained from other powerful tools. For instance, while you might use **Credit One Chat** to clarify a transaction on your statement, you'll rely on your free Experian credit report and FICO® score, or free TransUnion® credit report & score, to understand how that transaction impacts your overall credit utilization and payment history. Services like Intuit Credit Karma provide personalized recommendations, tools, and insights that help you optimize your money and grow it faster. This includes features like free credit monitoring, alerts, and personalized offers, all free, all in one place. When you receive an alert about a change on your credit report, or a personalized offer for a new financial product, you might then use **Credit One Chat** to understand how your existing Credit One account fits into these new opportunities or concerns. For example, if you're considering applying for a new credit product, you might chat with Credit One about your current credit limit or payment history to ensure your account is in good standing before applying. Similarly, if you need to place or manage a freeze to restrict access to your Equifax credit report, with certain exceptions, you would do this directly with Equifax, but you might use **Credit One Chat** to understand if a freeze could impact your Credit One account access or services. By integrating the immediate, account-specific support of **Credit One Chat** with the broader, holistic view provided by credit monitoring and financial optimization platforms, you create a robust strategy for protecting, understanding, and improving your credit.Conclusion: Empowering Your Financial Future

In conclusion, navigating the world of credit can seem daunting, with its myriad terms like credit reports, credit scores, credit freezes, and credit monitoring. However, modern digital tools are making it significantly easier to manage and understand your financial standing. **Credit One Chat** stands out as a highly effective and convenient channel for Credit One cardholders to engage directly with their bank, offering real-time support for a wide array of account-related queries. From basic balance checks to more complex inquiries about credit reporting and account impact, the chat service provides an immediate, documented, and often personalized solution that bypasses the traditional frustrations of phone calls. By leveraging **Credit One Chat** alongside comprehensive resources like free weekly online credit reports from Equifax, Experian, and TransUnion, and the personalized insights from platforms like Intuit Credit Karma, you empower yourself with a holistic approach to financial management. Remember, your credit reports play an important role in your financial life, and we encourage you to regularly check them. Experian is committed to helping you protect, understand, and improve your credit, starting with your free Experian credit report and FICO® score. By actively engaging with your credit accounts through channels like **Credit One Chat**, you're not just resolving immediate issues; you're taking proactive steps to optimize your money, grow it faster, and ultimately get ahead. We encourage you to explore the **Credit One Chat** feature the next time you have a question about your account. What has your experience been like using online chat for financial support? Share your thoughts and tips in the comments below!

Credit one chat - phdop

Sign In to Pay Your Bill OR See if You Pre-Qualify for a Credit Card

Credit One Bank Online Account