Unlock Your Financial Potential: A Deep Dive Into The Albert App

In today's fast-paced world, managing your finances can feel like an uphill battle. From budgeting to saving, spending to investing, the sheer volume of financial decisions can be overwhelming. This is where a powerful tool like Albert steps in, designed to simplify your financial life and put you firmly in control.

Albert, the acclaimed financial app, has emerged as a beacon for millions seeking clarity and efficiency in their money management. With its comprehensive suite of features, Albert aims to empower users to achieve their financial goals, offering everything from smart budgeting tools to early paycheck access and high-yield savings. This article will explore how Albert can transform your financial habits and help you build a more secure future.

Table of Contents

- Albert: Your All-in-One Financial Command Center

- Getting Started with Albert: A Seamless Onboarding Experience

- Mastering Your Money with Albert's Core Features

- Unlocking Instant Access to Funds with Albert

- Understanding Albert's Banking Framework and Security

- Seamless Support and Community Engagement with Albert

- Managing Your Albert Account: Withdrawals and More

- Why Albert Stands Out: A Commitment to Financial Empowerment

Albert: Your All-in-One Financial Command Center

In an increasingly complex financial landscape, simplicity and integration are key. Albert positions itself as your ultimate financial command center, consolidating various aspects of money management into a single, incredibly powerful application. The core promise is clear: "Take control of your finances with Albert." This isn't just a tagline; it's the fundamental principle guiding every feature within the app. From the moment you engage with Albert, you're invited into a world where budgeting, saving, spending, and even investing are seamlessly intertwined, designed to work in harmony for your financial well-being.

The app's popularity speaks volumes, with over "10 million+ people using Albert today." This widespread adoption underscores its effectiveness and the trust users place in its capabilities. For many, Albert becomes the central hub for their financial life, offering a clear, real-time overview of their money. Instead of juggling multiple apps for different financial tasks, Albert provides a unified experience, streamlining processes and making it easier to track progress towards your financial goals. This holistic approach is crucial for modern money management, where understanding the interplay between different financial activities is vital for sustained success.

Getting Started with Albert: A Seamless Onboarding Experience

Embarking on your financial journey with Albert is designed to be as straightforward and user-friendly as possible. The initial setup process is intuitive, ensuring that even those new to financial apps can get started without hassle. The first step, as with most modern applications, is to "download the Albert app onto your mobile phone from the app store." Whether you're an iOS or Android user, the app is readily available, making it accessible to a vast audience. This ease of access is foundational to Albert's mission of democratizing financial tools.

Once the app is installed, the registration process is equally simple and secure. To register, users are prompted to "open the app, enter your name, email address, and select a secure password." This standard procedure ensures that your account is protected from the outset, laying the groundwork for a secure financial environment. Albert understands the importance of security in personal finance, and this initial step is a critical part of building that trust. The focus on a smooth, quick, and secure onboarding experience means that users can transition from downloading to actively managing their finances with minimal friction, setting the stage for a positive and productive relationship with the app.

Mastering Your Money with Albert's Core Features

The true power of Albert lies in its robust suite of features, each meticulously crafted to address common financial challenges and empower users to make smarter decisions. These core functionalities form the backbone of the app's ability to help you budget, save, and grow your money effectively.

Budgeting and Smart Savings with Albert Genius

One of Albert's standout features is its intelligent approach to budgeting and automated savings, primarily driven by its "Genius" functionality. The app doesn't just present you with numbers; it actively works to optimize your financial habits. "Albert analyzes your income and spending to find small amounts we think you can afford to set aside, and we move your money automatically based on your settings." This automated saving mechanism is a game-changer for many, eliminating the need for manual transfers and the temptation to spend money before saving it. By identifying "small amounts," Albert makes saving feel less like a burden and more like an effortless habit, gradually building your financial cushion.

The "Genius" feature goes beyond simple automation. It acts as a personalized financial assistant, offering insights and advice tailored to your financial situation. Users can ask Genius a wide range of questions, covering "the basics budgeting cash instant savings investing protect advice commonly asked questions resetting your password getting set up what can I ask genius?" This conversational interface makes complex financial topics approachable and provides on-demand support, guiding users through everything from understanding their spending patterns to setting up investment goals. The proactive nature of Albert Genius, combined with its ability to adapt to individual financial behaviors, makes it an invaluable tool for anyone looking to optimize their budget and consistently build their savings without feeling overwhelmed.

High-Yield Savings: Making Your Money Work Harder

Beyond intelligent budgeting, Albert also provides avenues for your money to grow actively. The app encourages users to "open a high yield savings account to earn competitive rates on your deposits, over 9x the national average." This is a significant advantage in today's economic climate, where traditional savings accounts often offer negligible returns. A high-yield savings account through Albert means your idle cash isn't just sitting there; it's actively generating more money for you, accelerating your savings goals without requiring additional effort.

The emphasis on "competitive rates" and "over 9x the national average" highlights Albert's commitment to providing tangible value. For individuals looking to maximize their returns on savings, this feature is particularly appealing. It aligns with the principle of making your money work for you, a cornerstone of sound financial planning. By offering such attractive rates, Albert incentivizes saving and helps users build wealth more efficiently, making it a compelling option for anyone serious about optimizing their financial growth.

Unlocking Instant Access to Funds with Albert

Life is unpredictable, and sometimes, immediate access to funds can make all the difference. Albert understands this reality and offers features designed to provide financial flexibility and support when you need it most, without resorting to predatory lending practices.

Early Paycheck Access and Instant Advances

One of the most appreciated benefits for many Albert users is the ability to "get your paycheck up to 2 days early with direct deposit." This feature can significantly alleviate financial stress, especially for those living paycheck to paycheck, by providing access to earned wages sooner. It allows users to pay bills on time, avoid late fees, and manage unexpected expenses more effectively, offering a crucial buffer in their financial lives.

Furthermore, Albert provides "instant" advances, a lifeline for unexpected financial gaps. The process is designed for convenience: "To get started with Albert advances, head to the home screen in the app or online and tap instant. Follow the prompts to set up instant." This streamlined access to funds can prevent overdrafts or reliance on high-interest loans. Albert also encourages community growth through its referral program: "For every friend you invite to Albert, they’ll get access to advance $50 with instant when they join Albert and set up Albert." This not only expands the user base but also immediately benefits new users with a helpful financial boost, demonstrating Albert's commitment to supporting its community.

Albert Cash Debit Card: Flexible Spending and Cash Back

Complementing its other features, Albert offers the "Albert Cash Debit Card," providing a practical tool for everyday spending. This card isn't just for transactions; it also allows you to "cash a debit card with cash back," adding another layer of value to your spending. The ability to earn cash back on purchases is a simple yet effective way to save money passively, turning everyday expenses into small financial gains.

Managing your card transactions is also straightforward. Albert provides clear guidance on what to do "if I notice an error with an Albert card transaction," ensuring that users have support and recourse for any discrepancies. The app's comprehensive help center and resources, such as "See all 7 articles debit card what are my Albert cash debit card," offer detailed information and troubleshooting, empowering users to manage their card confidently and efficiently. This commitment to transparency and support reinforces the trustworthiness of the Albert platform.

Understanding Albert's Banking Framework and Security

Transparency and security are paramount when dealing with personal finances. Albert is upfront about its operational model: "Albert is not a bank." This crucial distinction clarifies its role as a financial technology company that provides tools and services, rather than acting as a traditional banking institution. Instead, "banking services provided by Albert’s bank partners." This partnership model ensures that your funds are held by regulated and insured financial institutions, providing a layer of security and trust that users expect.

Account security is a top priority for Albert. The app provides robust features for managing your account, including "resetting your password account security updating your profile managing your notifications external overdraft reimbursement policy accessing your tax documents." These functionalities empower users to maintain control over their account information and privacy. The availability of an "external overdraft reimbursement policy" further demonstrates Albert's commitment to protecting its users from common financial pitfalls, offering a safety net that can be invaluable. Accessing tax documents through the app also simplifies financial reporting, making tax season less daunting. This comprehensive approach to security and account management underscores Albert's dedication to providing a safe and reliable platform for its users' financial lives.

Seamless Support and Community Engagement with Albert

Even with the most intuitive financial tools, questions and concerns can arise. Albert prioritizes accessible and effective customer support to ensure users always have the assistance they need. For immediate answers, users are encouraged to "check out our help center for answers to common questions." This comprehensive resource is designed to be the first point of contact, providing clear, concise solutions to a wide array of queries, from setting up an account to understanding specific features or troubleshooting issues.

Beyond direct support, Albert also fosters a sense of community and encourages user engagement. The app actively promotes its growth through referrals: "We want to spread the word about Albert — so tell your friends." This not only helps Albert reach more people who could benefit from its services but also rewards both existing and new users, as highlighted by the instant advance incentive for referrals. This approach builds a network of users who are empowered to share their positive experiences, creating a virtuous cycle of growth and support. By combining robust self-service options with a community-driven referral program, Albert ensures that its users feel supported and valued throughout their financial journey.

Managing Your Albert Account: Withdrawals and More

Effective money management isn't just about saving and investing; it's also about having seamless access to your funds when you need them. Albert ensures that users have full control over their money, including the ability to withdraw funds easily. The question "How do I withdraw money from my account?" is a fundamental one for any financial service, and Albert provides clear mechanisms for this, integrating it smoothly into the app's user experience. While specific steps might vary slightly, the general principle is to make your money accessible on demand, reflecting the app's commitment to user convenience and liquidity.

Beyond withdrawals, the overall management of your Albert account is designed to be comprehensive and user-friendly. As mentioned earlier, features like "resetting your password account security updating your profile managing your notifications external overdraft reimbursement policy accessing your" tax documents are all part of the integrated account management system. This means that users can not only control their funds but also maintain up-to-date personal information, manage communication preferences, and review important financial documents, all within the secure environment of the app. This holistic approach ensures that every aspect of your financial relationship with Albert is transparent and manageable, reinforcing the app's reliability and user-centric design.

Why Albert Stands Out: A Commitment to Financial Empowerment

In a crowded market of financial technology, Albert distinguishes itself through its unwavering commitment to empowering its users. It's not merely an app; it's a comprehensive financial ecosystem designed to simplify, automate, and optimize your money management. From its intelligent budgeting and automated savings powered by Albert Genius to its high-yield savings accounts that outpace national averages, every feature is geared towards helping you build a stronger financial foundation.

The ability to get your paycheck early and access instant advances provides crucial flexibility, while the Albert Cash Debit Card offers practical spending solutions with added benefits like cash back. Crucially, Albert operates with transparency, clarifying its role as a financial technology company supported by reputable bank partners, ensuring the security and integrity of your funds. With robust customer support via its help center and a thriving community fostered through referrals, Albert provides a supportive environment for financial growth.

Ultimately, Albert aims to demystify personal finance, making it accessible and manageable for everyone. It helps users take control of their financial destiny, moving from a reactive approach to a proactive one. By leveraging technology to analyze income and spending, automate savings, and provide timely financial insights, Albert is more than just an app; it's a partner in your journey towards financial freedom and stability. Embrace the future of personal finance and discover how Albert can transform your financial life today.

Ready to take the next step in your financial journey? Visit Albert's official website or download the Albert app from your mobile app store to join millions who are already taking control of their finances. Share this article with friends and family who could benefit from smarter money management, and let's spread the word about how Albert can make a real difference!

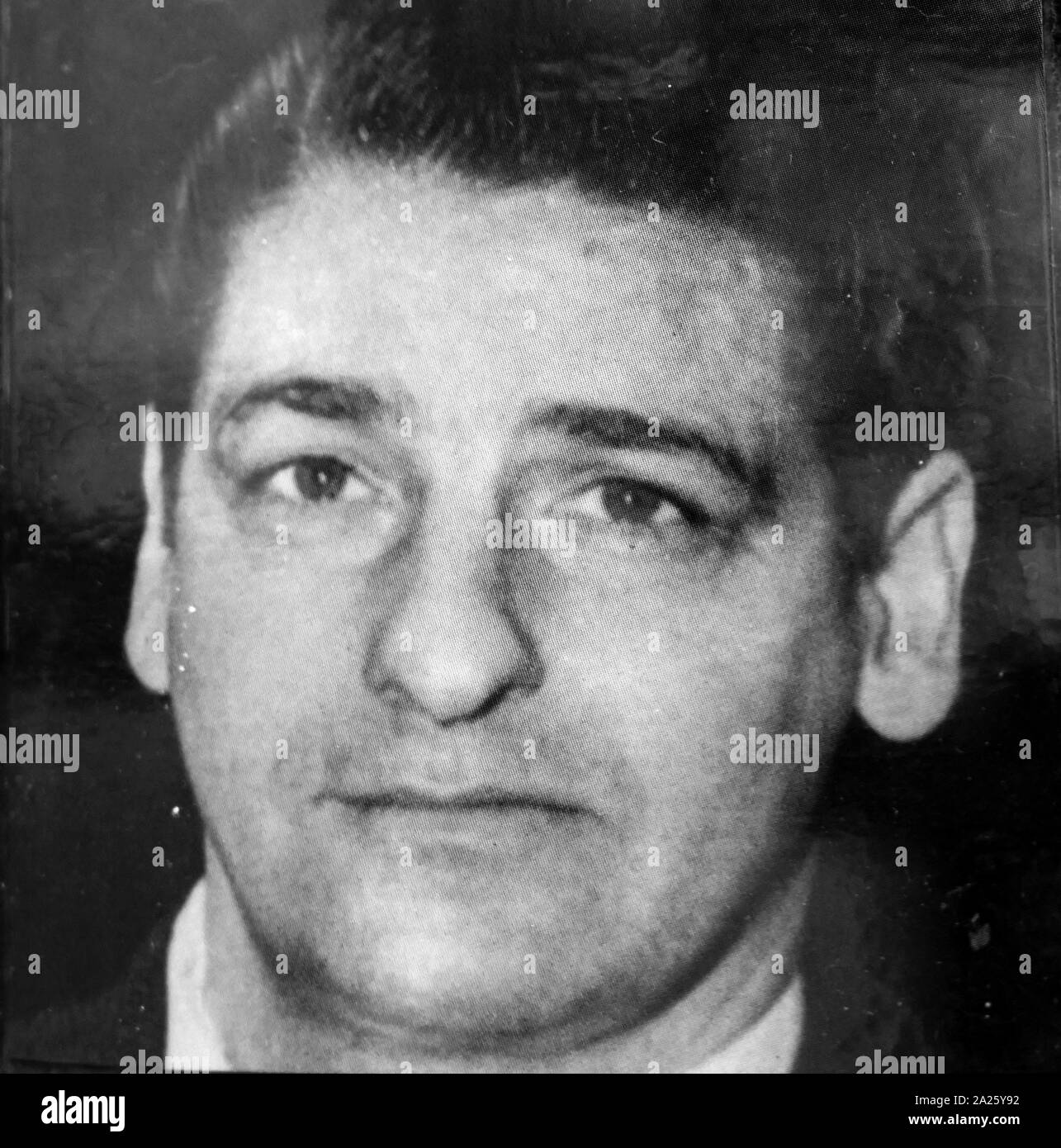

Albert DeSalvo

Who Was Albert DeSalvo, The Purported Boston Strangler?

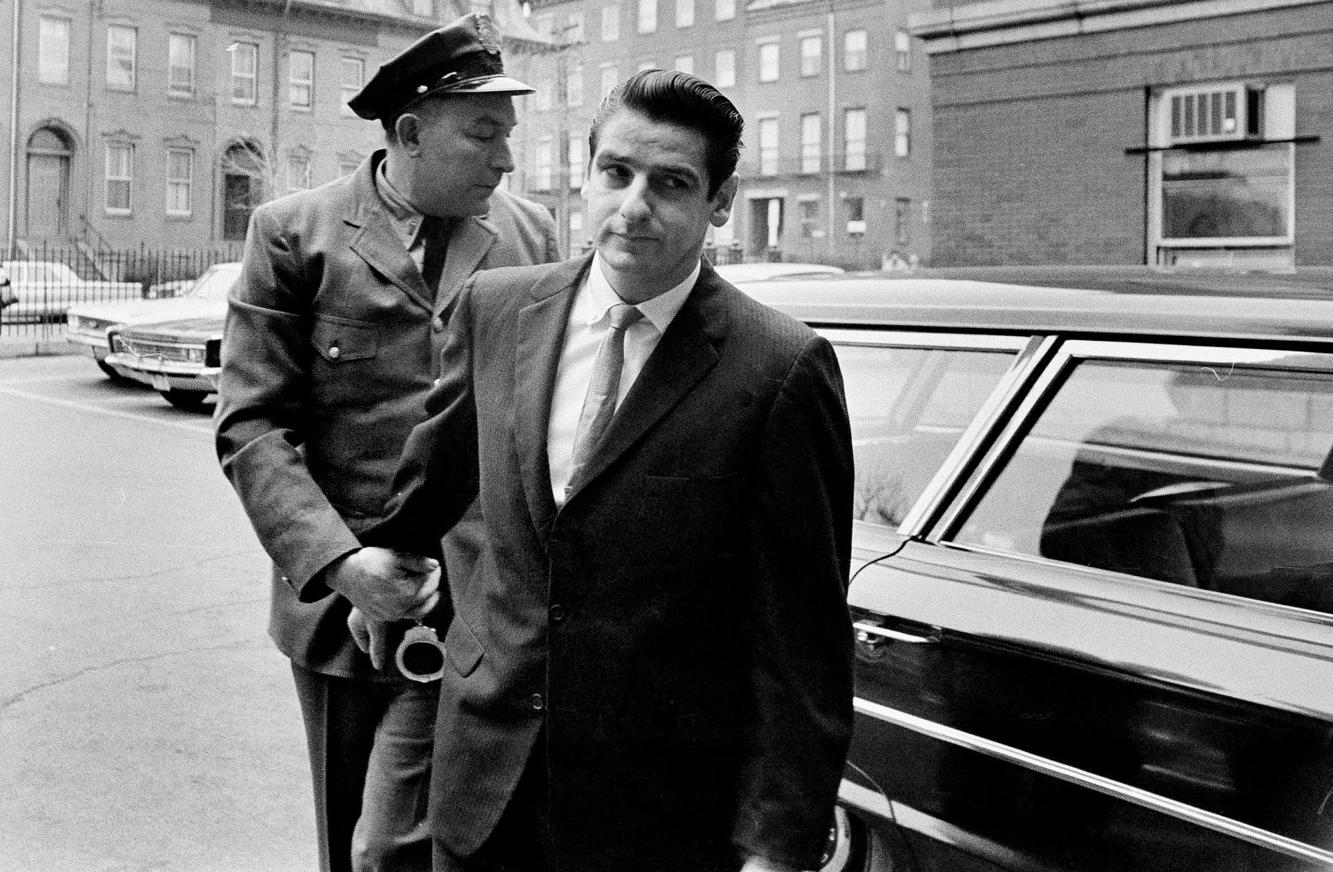

Photograph of Albert DeSalvo (The Boston Strangler). Alberto Henry